It usually takes about six months of practice to get the hang of it. Taking software-specific certifications can also enhance https://www.wave-accounting.net/ your credibility. These will help prove your expertise in specific bookkeeping and accounting software to clients.

Find a bookkeeper or accountant near you

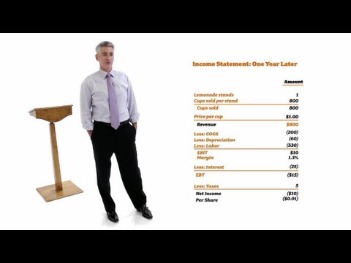

Some of these elements are done more regularly than others to ensure that the books are always up to date. Other elements are completed at certain time periods as necessary to complete a business task. We believe everyone should be able to make financial decisions with confidence. If your revenue is on the rise but your bottom line won’t move, it means you need to increase your profit margins. Tax-ready financial statements from a bookkeeper can help you recognize where you need to cut costs in order to make your business more profitable. Having your accountant file your taxes should feel like a quick hand-off, not a prolonged arm wrestling match.

How to Hire a Bookkeeper: Considerations + Free Job Template

But even the do-it-yourself business owner can benefit from consulting with a bookkeeping professional. Beyond number crunching, this type of professional can l make sure your bookkeeping software is set up correctly and that you are using it effectively. Some may also provide routine oversight to ensure your company’s books are accurately maintained and in good order.

Small Business Trends

- Robert Half can help the people we place securely access necessary data and applications, including virtual desktops.

- Smaller or less complex businesses might only need a few hours of bookkeeping services per month, so you aren’t onboarding a full-time employee.

- You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

- Having a bookkeeper that matches your needs will eliminate the stress and anxiety of doing this work yourself or having someone else do it who may not have the skills necessary.

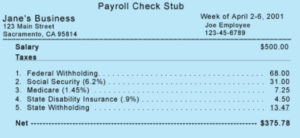

Simply put, bookkeepers are responsible for all financial activity and oversight of a business. They record and organize financial statements, ensure compliance with important tax rules, and facilitate all ingoing and outgoing payments on specific business what is the maximum validity for a post dated cheque in india accounts. Some accounting software products automate bookkeeping tasks, like transaction categorization, but it’s still important to understand what’s happening behind the scenes. It all begins with getting your accounting software set up correctly.

Best Online Bookkeeping Services of June 2024

Bookkeepers help solo entrepreneurs and small business owners take care of recurring financial tasks. This allows owners to spend more time doing the things they love and get paid for. Smaller or less complex businesses might only need a few hours of bookkeeping services per month, so you aren’t onboarding a full-time employee. If your accountant also does your bookkeeping, you don’t need to hire a bookkeeper.

Because a firm coordinates the work of multiple employees, it’s unlikely you’ll encounter the same service gaps you might expect from a single freelance bookkeeper. You don’t need to worry about your bookkeeper getting sick or leaving on vacation, since your books can be picked up by other other bookkeepers at the firm. That’s why it’s important https://www.business-accounting.net/bookkeeping-for-franchises-are-you-considering/ to find a bookkeeper who knows what they’re doing. However, expertise is not only measured by years of operation, or by third-party certifications. The books of an ecommerce startup are different from the books of a dentist; try to find a bookkeeper who has worked with businesses like your own before, and has experience in your niche.

You might also want to think about what you really need as a business to see if their services are in line with your needs. Maybe you’re not feeling confident enough with your bookkeeping skills and are unsure of where to begin—after all, you can’t be an expert on everything! Not having strong bookkeeping skills can also allow errors to occur.

With this type of service, you can communicate completely by email or phone without having to set aside time to meet in person. The responsibilities handled by a service will depend on the provider, so be sure to discuss the scope of work and compare options to find the right fit. Here’s a crash course on small-business bookkeeping and how to get started. If you’re interested in working remotely as a bookkeeper, applying directly or joining the Intuit Tax and Bookkeeping Talent Community may be the right move. Now that you understand how to become a bookkeeper, you are ready to get started on your new path. Whether you are already in the bookkeeping field or just starting out, this guide can help you determine your next steps.

Trusting the financial details of your business with anyone is a big step. It’s often the case that your bookkeeper will be the constant accounting contact for your business. They’ll be best placed to answer questions about where the money is coming from, and where it’s going. Significantly underpay your quarterly estimated taxes, and you’ll get saddled with fines from the IRS.

ED doesn’t necessarily approve all certificate programs at all accredited schools for federal student aid. If your certificate is approved, however, you can apply for federal student aid, which includes student loans, grants and scholarships. If you plan to attend college for your bookkeeping certificate, check that the school holds institutional accreditation from an approved accrediting body.

You may also pursue certification programs or use online courses to become a self-taught bookkeeper. Bookkeeping is the ongoing recording and organization of the daily financial transactions of a business and is part of a business’s overall accounting processes. Bookkeeping tasks provide the records necessary to understand a business’s finances as well as recognize any monetary issues that may need to be addressed. Proper planning and scheduling is key since staying on top of records on a weekly or monthly basis will provide a clear overview of an organization’s financial health.